At The Yukon Project our goal is to provide you with information to help you make your financial choices. Our free excel credit card consolidation loan calculator will show you four different pay off plans for your debts to help you determine your savings!

If you are considering a credit card consolidation loan to help you pay off your debt faster, you may want to know if it’s worth the effort. For some people, the juice isn’t worth the squeeze. For others, the savings could me thousands of dollars saved! What you need is a transparent comparison to calculate your personal savings.

Download our free excel Credit Card Consolidation Loan Calculator!

Credit card consolidation loans save you money on your debt repayments by replacing your high interest credit card debt with a low interest rate. They bring all your payments into one and can save you thousands of dollars in interest.

How to use the credit card consolidation loan calculator

Step 1: Go to the “Debt Inputs” tab

On this tab you will find content written in white and black fonts. All cells in white fonts should be updated with your information.

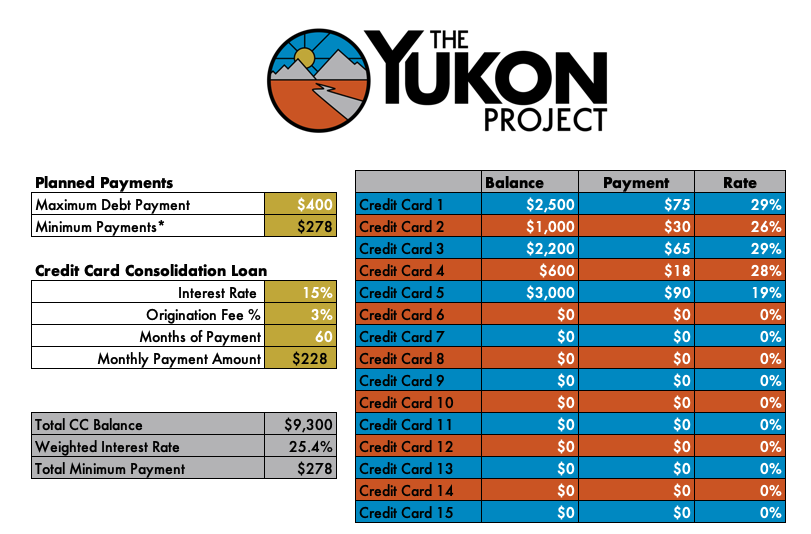

Step 2: Input your current credit card debts

You will input your outstanding balance, current payment amount, and interest rate for each credit card or debt, up to 15!

Note, you must input a payment large enough to pay off the debt within 10 years. This may be more than the minimum payment required by your credit card. Put your information in the Blue and Orange boxes. You can even customize your list by replacing the generic labels with your debts, but that doesn’t change the calculations.

Step 3: Input your maximum monthly debt payment

This is the amount that you pay each month towards your credit card debt. The calculator will use your input to calculate your payoff with the debt snowball method and an accelerated payoff of your credit card consolidation loan.

Step 4: Input your credit card consolidation loan details

If you have already applied for a loan and want to see how it will help you, you can input your exact loan details. If you haven’t, it’s ok to estimate and see what rates would be good for you. Based on the current market, you should assume an origination fee of 3% to 5% and an interest rate between 15% and 28%. Your actual loan will depend on your personal circumstances and lender. You can apply with up to 40 lenders at once here.

Step 5: Review your results

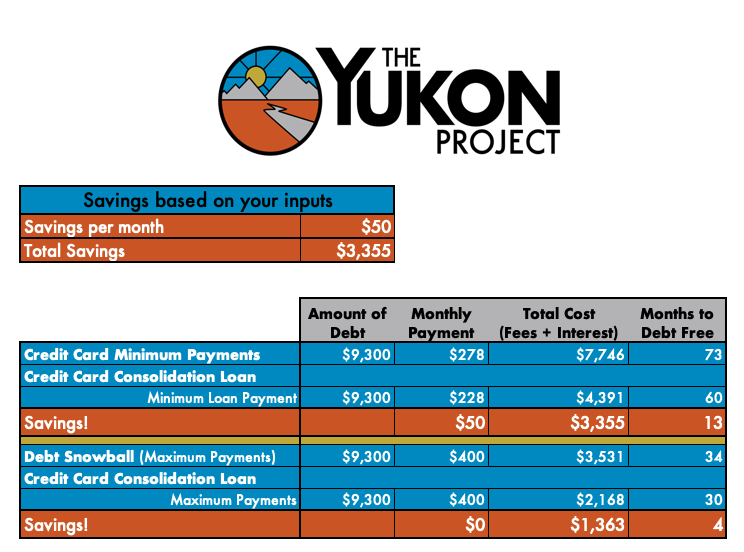

Click on the “Summary of Payoffs” tab. Here you will see the details of your payoff plan based on the input you choose. This shows four total payoff plans, by comparing a credit card consolidation loan to paying the credit cards directly!

The top section compares paying minimum payments on your credit cards (see minimum payment assumption below) to making the standard payment on your loan.

The bottom section compares a debt snowball plan to a credit card consolidation loan using the same payment amount for each. This means you would pay more than the minimum monthly payment each month on the loan.

About the credit card consolidation loan calculator:

There are limitations to any calculator. This calculator has some limitations and may not be valid in all cases. We have created this Excel calculator to help you determine if a credit card consolidation loan would be a good idea for you. Please keep these things in mind as you use the calculator.

Minimum Payment Assumption

This calculator assumes you continue making your current minimum payment until the debt is paid in full. However, credit card minimum payments are lowered each month as you reduce your debt. That means if you make the true minimum payment, you will be in debt far longer and pay far more in interest.

Interest Calculations

This calculator uses simplified interest formulas and does contain some rounding. That means the actual costs could vary slightly. This calculator is not legal or financial advice. It is a means to help you have the facts available when making a decision.

Download our free excel Credit Card Consolidation Loan Calculator!

Who saves the most with credit card consolidation loan

If you’re curious, you can test out many different scenarios with this calculator. I’ve done a lot of work on this already so here are a few tips to know when the savings are the highest.

Higher debt amounts

Credit card consolidation loans are generally more valuable the more debt you have to consolidate. Most of the time, people owing $5,000 or less may not see enough financial gain to make the loan a worthwhile process. Conversely, having $10,000 or more in high interest credit card debt is often worth it!

Higher interest rates

The savings for a credit card consolidation loan comes from lowering your interest rate. Most credit cards have an interest rate of 24% or higher. Some may be over 30%! But not all are that high. In fact, some credit cards have rates as low as 12%. If you’re interest rates are on the lower end, you won’t save as much. If you’re one of the millions with interest rates of 24%, 26% or 30%, you could save a lot with the right credit card consolidation loan.

Low payment amounts

Paying off your debt is about payments. If you can only afford to pay the minimums, then getting a credit card consolidation loan could really help you pay off your debt faster. However, if you put a significant amount toward your debts each month and use the debt snowball method, then you may not save much.

Word of caution

A credit card consolidation loan can save you money, but only if you use it wisely. If you consolidate your credit card debt, you must resist the temptation to add debt back to your credit cards.

Here are a few suggestions to help you.

Don’t use them at all

While you will give up any benefits you gain from the credit cards this way, it is a certain way to prevent adding new credit card debt. Over time, as the accounts are closed or become inactive, you will likely see a drop in credit score. This drop should be slow and may take 12 to 36 months.

Plan to pay the balance in full

As long as you pay your credit card balance in full each month, you won’t pay interest or accrue new debt. This allows you to reap any rewards from your credit card programs. It also allows you to maintain these active accounts on your credit score.

Use the “double autopay” method

This is a plan where you use the credit cards once a month to maintain activity for your credit score. In short, you use your credit card to autopay a regular bill that you have already budgeted for (think your Netflix account or your water bill). Then pay the credit card balance with autopay as well. You can learn more about this strategy here.