Everything to know about Wells Fargo’s personal loans from $3,000 to $100,000. Do you qualify?

We’re going to tell you everything you need to know about Wells Fargo’s personal loans. We’ve spent years in the lending industry and we track dozens of lenders. We want to use that experience to help you make sense of Wells Fargo’s policies so you can decide whether you should use them to consolidate your credit card debt, make a big purchase, or cover a monthly shortfall in your finances.

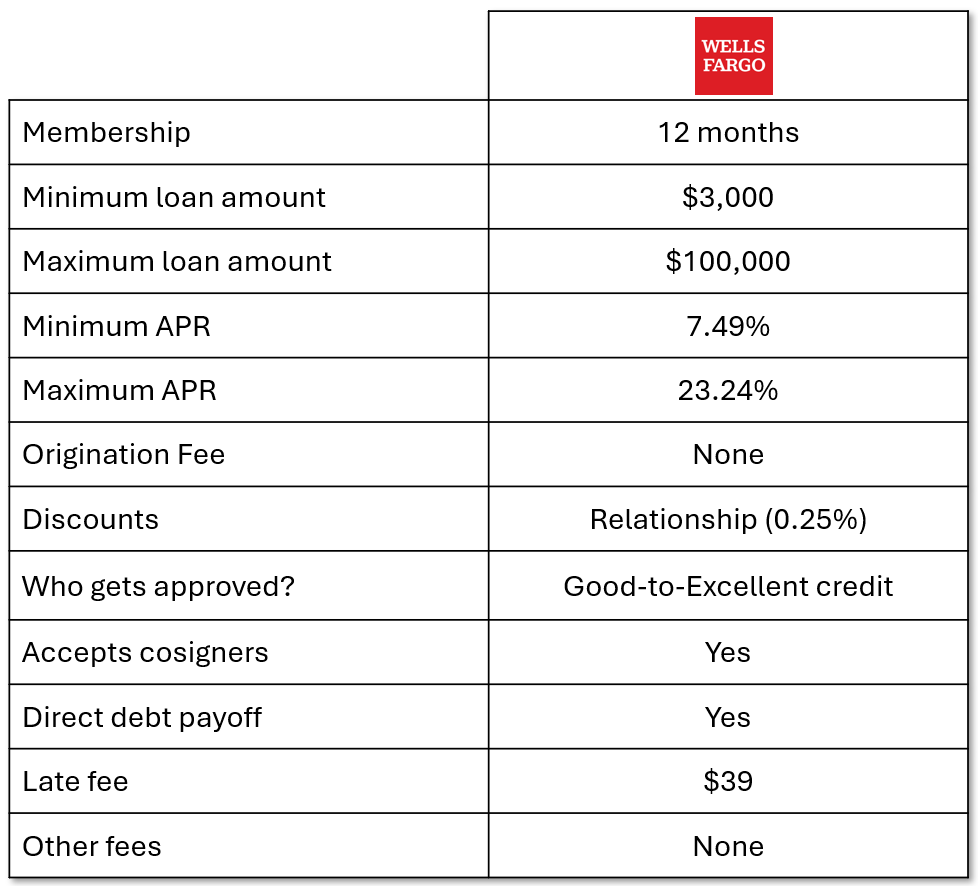

Before we get into all the details, I want to tell you about one detail that might save you the trouble of watching the rest of this video. Wells Fargo restricts their personal loans to people who have had a Wells Fargo account for at least 12 months. No matter what else you like about them, that might eliminate them from consideration for you. If you aren’t eligible for a Wells Fargo loan, we can help you find a lender that meets your needs. At The Yukon Project, you can check your rate with up to 40 lenders all at the same time. More on that at the end of the video.

The first thing we are going to look at is how much you can borrow from them.

Wells Fargo will not lend less than $3,000. So, if you are looking for just a little bit of money to cover an emergency, Wells Fargo might not be the first place to look. If you are looking for a more substantial amount of money, they will lend as much as $100,000. That is about as high as any personal loan.

Wells Fargo issues loans with terms between 1 and 7 years.

Seven years is a long time to carry debt, but if you are borrowing a $100,000, you might need a term that long. Longer terms will mean smaller monthly payments. But it will also mean paying more in overall interest compared to a shorter term. No matter what your term is, if you make extra principal payments in the first year, you will save a lot of money on interest and get out to debt quicker.

Now let’s look at the interest rates for Wells Fargo’s personal loans.

Their minimum APR is 7.49%. That’s an extremely respectable low number. But, only about 10% of their borrowers are likely to receive a rate that low. Their top rate is 23.24%. That top rate is better than most, but not as good as some.

Wells Fargo does not charge an origination fee on their personal loans. About half of all personal loan lenders will not charge an origination fee. This means that the full cost of the loan is wrapped up in the interest rate.

Wells Fargo will offer a Relationship discount of 0.25%.

A “relationship discount” is just marketingspeak for customers who are signed up for autopay from a Wells Fargo account. It makes sense that Wells Fargo would want to incentivize you to have your paycheck deposited into a Wells Fargo account.

Wells Fargo lends to people with Good-to-Excellent credit. I would think you would struggle to get approved if your credit score was below 670, but that’s just a guideline. In determining your eligibility, Wells Fargo will look at your credit score, but they will also look at other things like your payment history, debt-to-income ratio, utilization, amount and type of income, bank transaction data, and other financial information. Your particular mixture of these factors will determine if you are approved, for how much, and at what rate.

Wells Fargo will allow you to include a cosigner on your loan application.

A cosigner is someone who agrees to pay off your loan if you fail to repay it. If you think you might struggle to get the loan and terms that you need, a cosigner could strengthen your application. This is probably only true if your cosigner has a stronger credit profile than you do. If you can get the loan you need on your own, you should not include a cosigner. In that case, there is no reason to entangle a loved one in the process.

If you want to use the personal loan to consolidate credit card balances or other loans, Wells Fargo will directly pay off your other debts for you from the proceeds of the loan. It’s convenient when a lender will do that, but it’s important for another reason. It shows that the lender is taking into account that the new loan will replace your other debts and not stack on top of them. This keeps your debt-to-income ratio from getting worse. That means it should be easier to get approved by them.

A lot of banks will not let you consolidate balances from credit cards that they issued. Wells Fargo does not appear to have this limitation.

If you are late on your payment, Wells Fargo will charge you $39. That’s the highest late fee from any of the lenders that we track. So, if you are the kind of person who is chronically late on your payments, borrowing from Wells Fargo could get expensive. Some lenders will charge other fees as well: things like failed payment fees or paper check fees. But, Wells Fargo does not have any additional fees.

What can you use a Wells Fargo personal loan for? Wells Fargo does not limit how you use the money. Because it’s a personal loan that is unsecured, you are free to use the funds however you would like. The most common uses of a personal loan include: credit card or debt consolidation, home improvement or home repairs, major purchases, life events like marriages, funerals, having a baby, adopting or moving, vehicle repairs, or unexpected emergency.

Let’s summarize Wells Fargo’s personal loans.

Wells Fargo will only approve personal loans to people who have had an open Wells Fargo account for at least 12 months. They offer large loan amounts from $3,000 to $100,000. They have competitive interest rates and no origination fees. But, they are likely to be pretty restrictive about who they lend to. You will probably need good-to-excellent credit to be approved. They offer good features that can help people who are trying to get on top of their finances. I don’t love their high late fee, but I appreciate that they don’t have any other fees. I think Wells Fargo is a pretty decent lender. And could be quite convenient if you already do most of your banking with them.

Of course, for many people, the most important thing about a loan is whether you can get the money you need with the best terms. That’s why we always recommend that before you accept a loan, you should shop around. Find the best deal. Get three to four offers before you make a decision on which loan to take. At The Yukon Project, we’ve tried to make shopping around easy. If you visit our marketplace page, you can apply to any one of our other featured lenders. Behind the scenes, we will check your rate with up to 40 other lenders. Our partners use a soft credit check, so applying won’t hurt your credit score. We will show you all of the approved offers so you can pick the loan that’s best for you.

If you have any questions we didn’t cover, leave a comment below and we will try and answer it. If you found this video useful, please like it and subscribe to our channel. Thanks for watching.

Stop paying the high interest rates from carrying a monthly balance on your credit card! Whether you need a small amount or $100,000 we have options for you!

Soft Credit Pull, Up To 40 Lenders at Once, See what you’re approved for!