Is $2,000 to $20,000 Personal Loan From OneMail Financial Better Than A Personal Loan From Prosper For You? Detailed Review Across 11 Criteria.

We’re going to compare personal loans from Prosper and OneMain Financial. We’ve spent years working in the lending industry and we track dozens of lenders. We want to break down these two lender so you can see which one might be better for your situation.

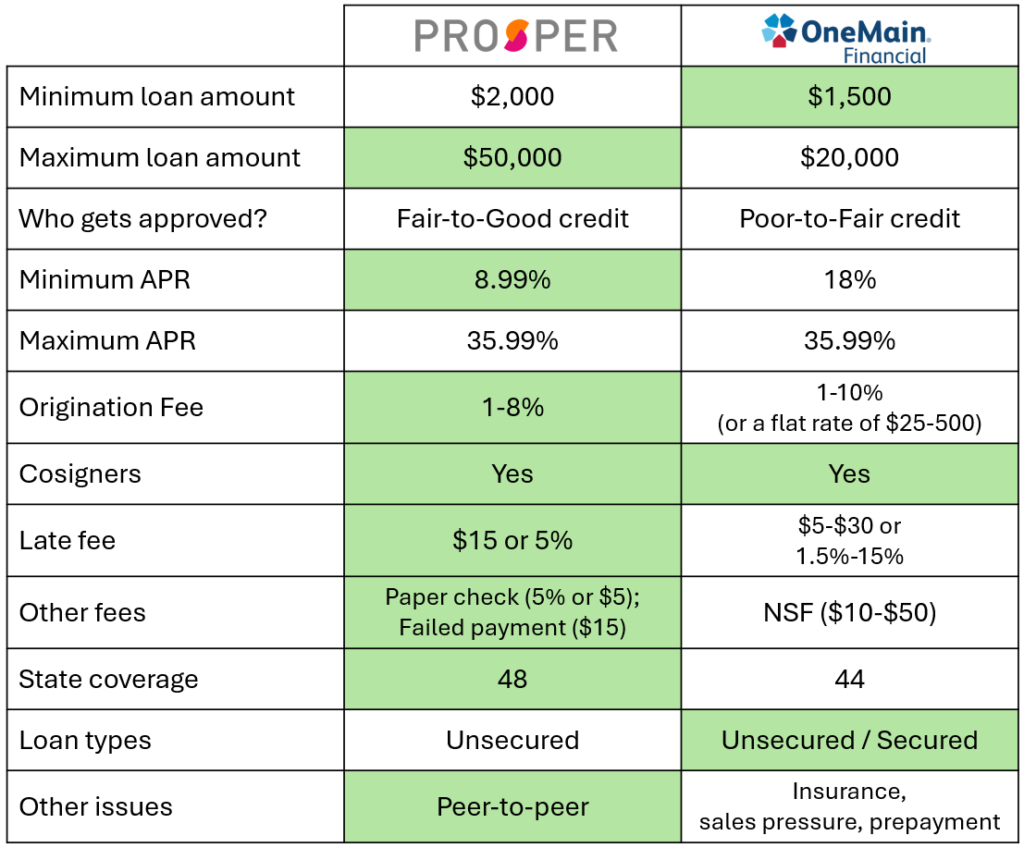

First, let’s look at the loan amounts that they offer. Prosper has a minimum loan amount of $2,000 while OneMain will lend as little as $1,500. So, if you are looking for just a little bit of money to cover a monthly shortfall, OneMain has more flexibility on the low side. If you are looking for a more substantial amount of money, Prosper lends as much as $50,000 and OneMain’s top amount is $20,000. So, Prosper gets highlighted on the upper end.

They also both have terms that run from 2 to 5 years, which is pretty standard for personal loans of this size.

Who can be approved can be a bit of a guessing game. My research suggests that Prosper lends to people with Fair-to-Good credit. I think they lend down to 620 on the credit spectrum, but that’s just a guideline, of course. Prosper is a bit different than other lenders. They use a combination of things like a credit score from TransUnion, your income, and your other expenses to give you a specific Prosper rating. The Prosper rating has seven grades which is meant to explain credit risk. Those grades are: AA, A, B, C, D, E, and HR. Between 55% and 60% of all their loans are going to people in the top three grades. I believe that at least half of their borrowers have credit scores above 680.

OneMain lends to people with Poor-to-Fair credit. That means that OneMain is willing to lend to people below 620. In fact, just over half of their borrowers have credit scores below 620. I believe that OneMain will lend down into the mid-500s. Of course, the lower you go down in their ranges, the less likely you are to be approved. And the more likely they will encourage you to secure your loan to be approved. We’ll talk more about that later.

Now let’s look at the cost of the two loans. Prosper’s lowest APR is 8.99% and OneMain’s 18%. That’s a pretty significant difference and probably reflects the different credit quality of the customers that they will approve. Prosper gets highlighted. Both Prosper and OneMain Financial caps their top APR at 35.99%.

Prosper charges an origination fee of between 1% and 8%. OneMain’s origination fee structure is significantly more complicated. Their fees range from 1% to 10%. But in some cases it would be a flat rate of $25 to $500. Why the confusion? Well, OneMain will charge the most that they can given the state laws in which they operate. That means that it will depend on what your state’s regulations limit. I am going to highlight Prosper for its clarity. I also suspect that OneMain will always maximize their origination fee, otherwise they could have made it considerably simpler.

The origination fee is a percentage of the borrowed amount and comes out of the proceeds of the loan. So, if you borrow $10,000 and have a 5% origination fee, you will receive $9,500 but will still need to repay the $10,000. Remember that the origination fee is accounted for in the APR. The APR is the origination fee plus the interest rate. All things being equal, you want a lower origination fee if you plan on paying off your loan early. Paying off early will save you on the interest you would have paid, but you don’t get a reimbursement of the origination fee.

Both Prosper and OneMain will accept cosigners on their loans. A cosigner is someone who agrees to pay off your loan if you fail to repay it. If you can qualify for the loan that you need, there is little reason to entangle a loved one in the process. But, if you have a spouse or loved one that has a stronger credit profile than you do, adding them as a cosigner might make all the difference in getting the loan you need. Since they both allow cosigners, I am going to highlight both of them.

If you’re late on a payment, Prosper will charge you $15 or 5% of the late amount, whichever is higher. OneMain charges $5 to $30 or it could be 1.5% to 15% of the late amount. Again, I believe state regulations will dictate what they can charge. But 15% of the late amount is an eye-popping number. So, you will want to keep an eye on what they will charge you in your state. I am going to give this category to Prosper because it appears to be generally lower, and–again–I suspect OneMain is maximizing what they can charge.

Both Prosper and OneMain charge other fees as well. Prosper charges a fee if you want to make your payment by paper check instead of ACH withdrawal. They also charge you if they attempt an ACH draw, but the payment fails because there’s not enough money in the account. OneMain has this same fee, but they call it an NSF fee or a “Non-sufficient Funds” fee and they charge between $10 and $50. Fifty dollars seems so outrageously high that I have to double check it every time I see it. Yup, it really can be that high. So, I give this category to Prosper.

If you are using the loan to consolidate credit card balances of other debt, neither Prosper nor OneMain Financial will use the loan’s proceeds to pay off your other debt for you. I like it when companies will do that because they understand that the loan is meant to replace your other debts and not just stack on top of them. The fact that neither of these companies will do it probably means that it would be harder to get approved with them if you want a loan for the purpose of consolidating debt.

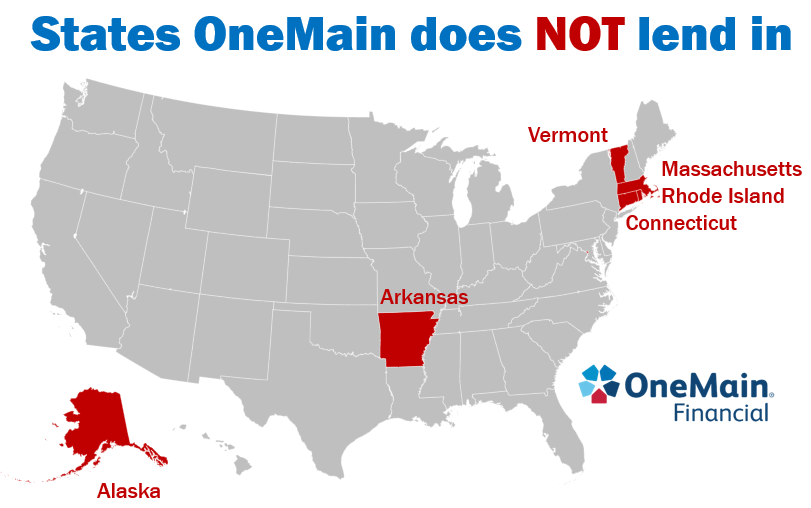

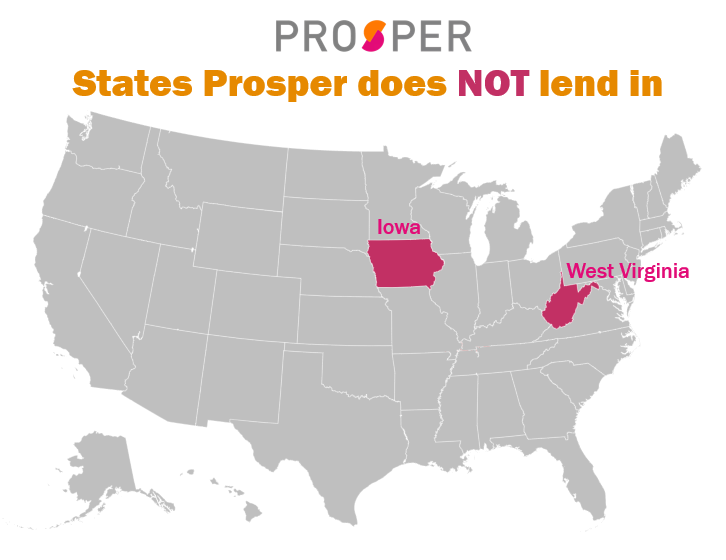

You conduct the entire application process for a Prosper loan online. You can apply for a OneMain loan online as well or you can go into one of their 1300 storefront locations. Those 1300 locations can be found in 44 states. They do not lend in Alaska, Arkansas, Connecticut, Massachusetts, Rhode Island, or Vermont. Prosper, on the other hand, lends in 48 states. They do not lend in Iowa or West Virginia. While it doesn’t seem terribly significant, we are going to highlight Prosper since they lend in four more states.

Prosper only offers unsecured loans. That means that if you have trouble repaying the loan, they can’t come seize any of your assets as repayment. OneMain offers unsecured loans, but they also offer secured loans. This would be where you put up the title to your motor vehicle as collateral on the loan. If you fail to repay, they can repossess your car. I generally think that personal loans should be unsecured. There’s no reason to risk making your financial situation even worse by losing an important asset like your motor vehicle if you run into additional trouble. However, it is often easier to be approved for a secured loan, or be approved for more money. So, if you are having trouble getting approved, a secured option might solve the problem. I am going to highlight OneMain because it has more options.

One issue that you ought to be aware of is that Prosper started it’s life as a peer-to-peer lender. The idea was that individuals with money would come to the site and decide to lend money to people who needed loans. It would be an investment opportunity with people who have money and Propser (the company) would be able to avoid the regulatory scrutiny of traditional banks and lenders. Because, after all, Prosper isn’t the lender. Well that was the idea. But, that model didn’t stick around. You can still invest in loans through Prosper, but the actual lending is being done by a bank (WebBank), and most of the money for that lending is not coming from individuals like you and me.

There are a few issues that I need to bring up when it comes to OneMain Financial. OneMain has several different kinds of insurance that they will try and get you to buy. The cost of the insurance will not be accounted for in the APR, so paying for the insurance could make borrowing from OneMain Financial more expensive than you expected. They like to insure any collateral you put up, so they might actually encourage you to put up the title to your motor vehicle so they have another way to make money on the loan. You do need to know that they cannot require you to buy the insurance, otherwise it would have to be accounted for in the loan’s APR.

That kind of leads to the second issue: sales pressure. If you go into the store to complete the process, you might be subjected to some sales pressure. I am most concerned that they will make you feel like you need to buy their insurance or sign loan agreements before you have done all the shopping around that you should do.

The last issue we need to talk about is that they don’t make it easy to pay off the loan early. I am most concerned about this one because you should go into any personal loan with a plan to pay it off early. When you make extra payments to OneMain, you are just prepaying future payments rather than paying down the principal. That just means that you are paying for the interest before it has even been accrued. You don’t actually save money on interest by making extra payments. To apply extra payments to principal, you need to call and work directly with their customer service team. We have heard a few customers report that it is a very difficult process. One customer flat out said that they were never able to do it.

Let’s summarize what we’ve learned about personal loans offered by Prosper and OneMain Financial.

Prosper has considerably more green cells than OneMain Financial. But many of the categories are dependent upon the deal that you might get from them. So, it is distinctly possible that OneMain could be your better option, especially if you have poor credit. In that case, it’s very possible that Prosper wouldn’t even approve you. But, if you do go with OneMain financial, you need to go in with your eyes wide open about the possible up-selling and the potential difficulty in paying the loans off early. You should also remember that these aren’t the only lenders you could consider. The best way to make sure you’re getting the best deal that you can qualify for is to shop around. And one of the most efficient ways of shopping around is to visit our marketplace page at The Yukon Project.

At The Yukon Project, we’ve tried to make shopping around easy. If you visit our marketplace page, you can apply to any one of our other featured lenders. Behind the scenes, we will check your rate with up to 40 other lenders. Our partners use a soft credit check, so applying won’t hurt your credit score. We will show you all of the approved offers so you can pick the loan that’s best for you.

If you have any questions about either of these lenders that we didn’t cover, leave a comment below. If you found this video useful, please like it and subscribe to our channel. Thanks for watching.

Stop paying the high interest rates from carrying a monthly balance on your credit card!

Soft Credit Pull, Up To 40 Lenders at Once, See what you’re approved for!